salt tax deduction new york

This consequential tax legislation available to electing pass-through entities provides a. The SALT cap essentially resulted in a pretty large tax increase for a lot of families in the suburbs of New York City Mr.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000 charitable contribution instead of being limited to a 10000 deduction for the total state and local taxes paid.

. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. Ron Cook David Landwehr New Yorks pass-through entity tax will allow certain partnerships and New York S corporations an annual election to pay income tax on behalf of its owners. SALT paid by the.

The SALT cap limits a persons deduction to 10000 for tax years beginning after. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. How New York State Responded to The SALT Deduction Limit.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local. The SALT deduction was limited to 10000 in 2017 when President Donald Trump signed into law a 15 trillion overhaul of the federal tax code. New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround.

While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation. In 2018 Maryland was the top state at 25 percent of AGI. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that the Trump administration limited to 10000.

New Yorks SALT Workaround. In California the deductions value fell from 81 percent in 2016 to just 18 percent in 2018. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services Bulletin issued on August 25 2021 TSB-M-21 1C 1I.

New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. New York enacts pass-through entity tax election as SALT deduction workaround October 1 2021 Article 1 min read Authors. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

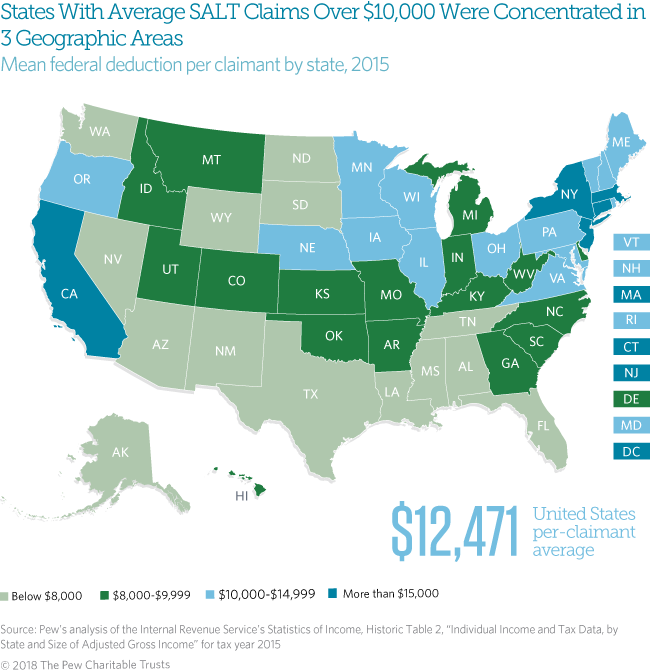

The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent. Tom Suozzi has taken a leading role in fighting to restore a tax deduction that is important to people who live in and around New York City and might be laying the groundwork for. The pass-through entity tax represents a welcome tax planning opportunity for New York State individual taxpayers given that these taxpayers were traditionally among those with the highest average federal deductions for state and local taxes before the implementation of the SALT limitation.

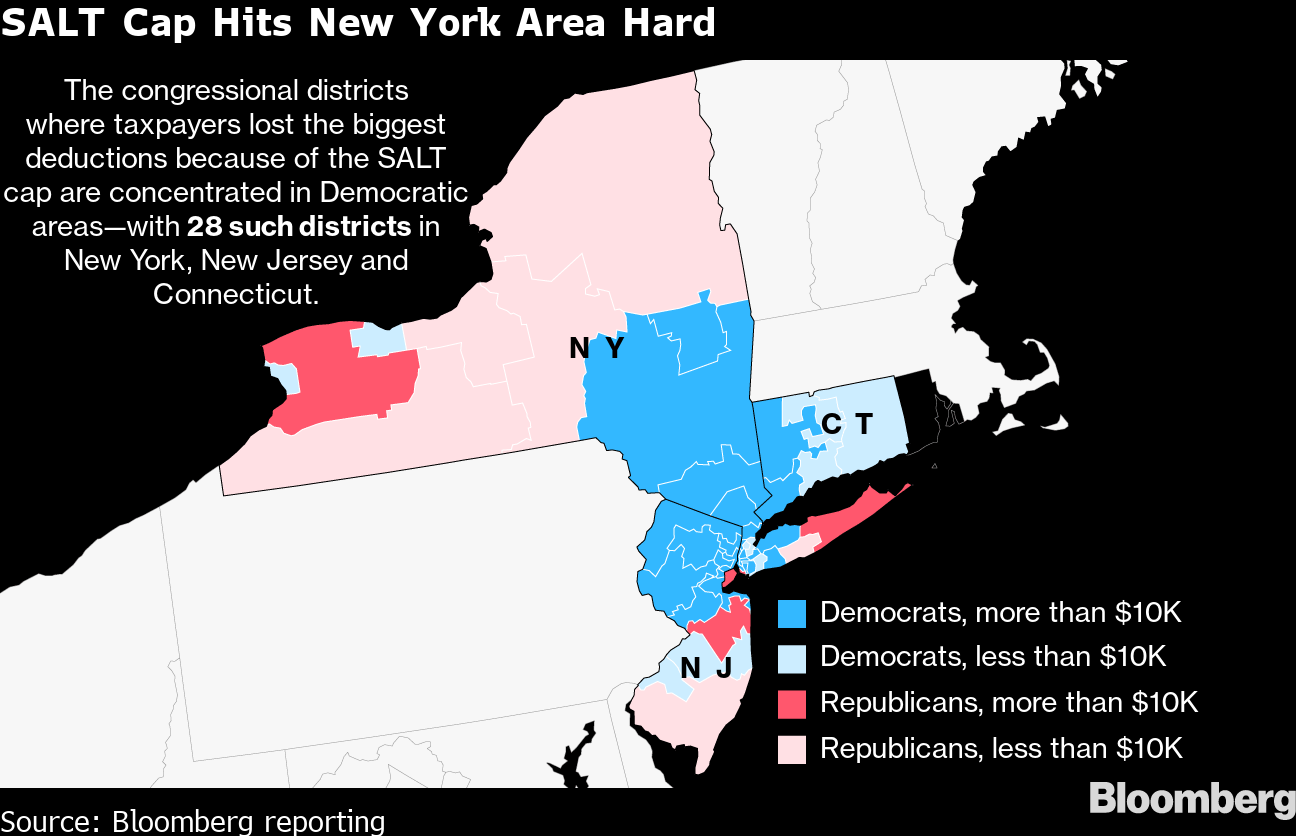

The SALT cap essentially resulted in a pretty large tax increase for a lot of families in the suburbs of New York City Mr. Overall the SALT deductions value as a portion of AGI fell between 2016 and 2018. A handful of Democratic lawmakers mostly moderates from the New York and New Jersey suburbs had threatened to scuttle the bill if their concerns about the SALT cap were not addressed.

A Democratic proposal aims. The Pass-Through Entity tax allows an eligible entity to pay New York State tax. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021. In April 2021 New York State enacted legislation providing for a new elective pass-through entity PTE tax on partnerships and Subchapter S corporations. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

This new legislation is better late than never since. Published January 4 2022 at 506 PM EST Mark Lennihan AP Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that the. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

This provision is not available for publicly traded partnerships. The SALT deduction allows you to deduct your payments for property tax payments and either. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. The plan was authored by Congressional Republicans. The 2017 Tax Cuts and Jobs Act generally limits an individuals deduction of state and local taxes to 10000 per year the SALT Deduction Limitation.

But some liberals quickly balked at the emerging agreement which would suspend a 10000 cap on the so-called SALT deduction for five years removing a limit that Republicans included in their. With Democrats in power those homeowners are.

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

Opinion The Debate Over A Tax Deduction The New York Times

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

State And Local Tax Salt Deduction Salt Deduction Taxedu

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

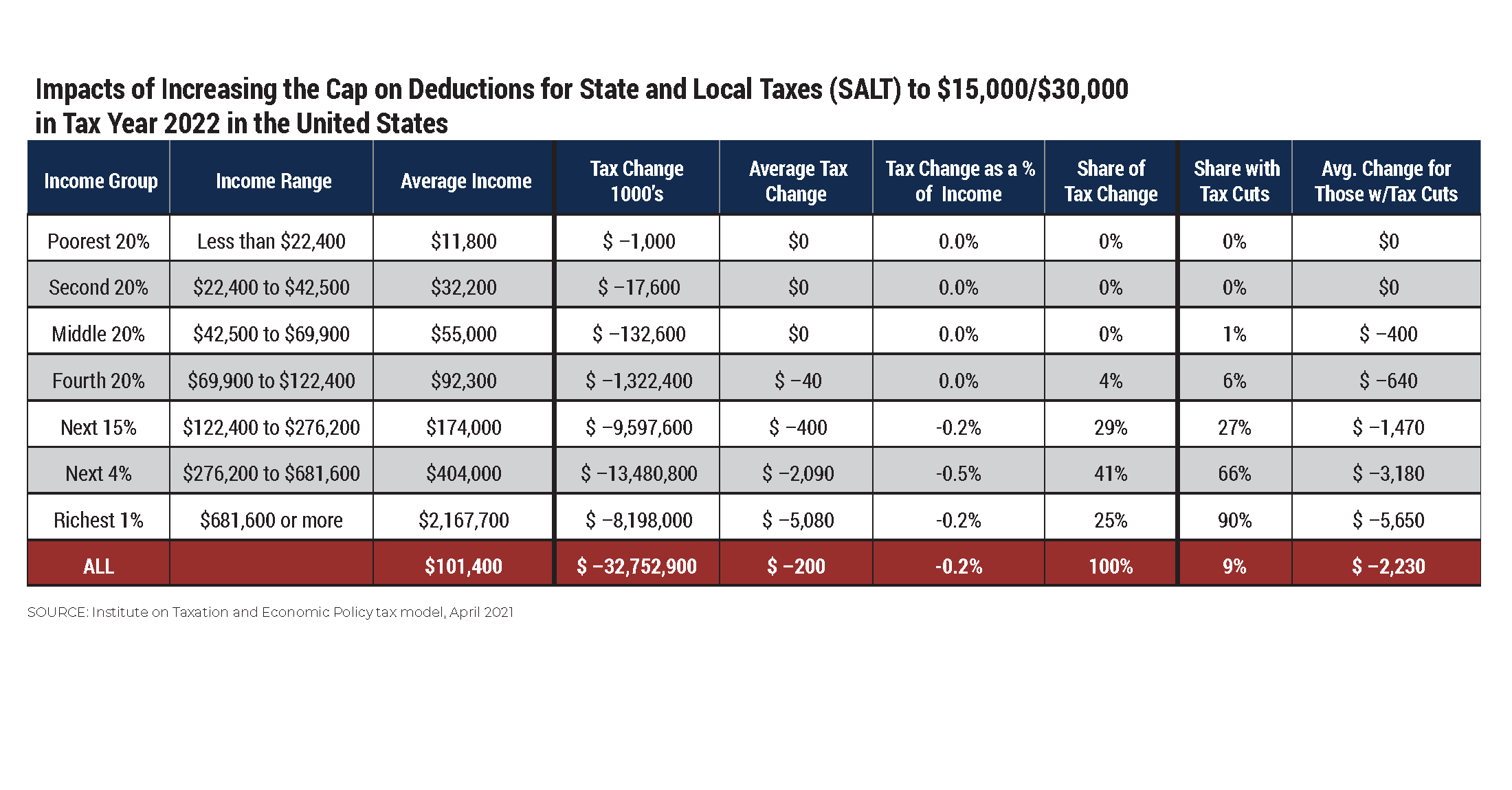

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times